URD 2023

-

Review of the year

1.1Activity report

In 2023, the + 0.6% increase in household purchasing power, supported by higher wages and savings income, was reflected in + 0.7% growth in household consumption, following + 2.1% in 2022, according to the latest Banque de France forecasts from December 19, 2023. This trend masks a number of trade-offs made by consumers with their spending to limit the impacts of inflation, which remained high in 2023, with consumer prices climbing + 4.5% year-on-year in the last quarter of 2023.

2023 also marked a major realignment of the food retail landscape in France, with the successive announcements, on May 26, 2023 of a memorandum of understanding between the Casino group and Groupement Les Mousquetaires to transfer Géant stores to the Intermarché banner, followed on December 18, 2023 by the exclusive negotiations launched by the Casino group with Auchan Retail and Groupement Les Mousquetaires with a view to selling virtually the entire scope of the Casino group’s hypermarkets and supermarkets (excluding Corsica, not included in the scope by the Casino group). These discussions led to an agreement for Groupement Les Mousquetaires and Auchan Retail to acquire 288 points of sale. On January 24, 2024, Carrefour also announced that it had entered exclusive negotiations with Intermarché with a view to acquiring 31 points of sale. Under the terms of this agreement, Carrefour will replace Intermarché to acquire 26 stores from Casino, with the other five stores to be acquired directly from Intermarché.

On January 25, 2024, the magazine LSA published the list of the 31 stores acquired by Carrefour, including the Lanester and Le Puy hypermarkets, owned by Mercialys.

This operation, which remains subject to several approvals being obtained, particularly from the competition authorities, will considerably diversify the Company’s rental base, improving its risk profile.

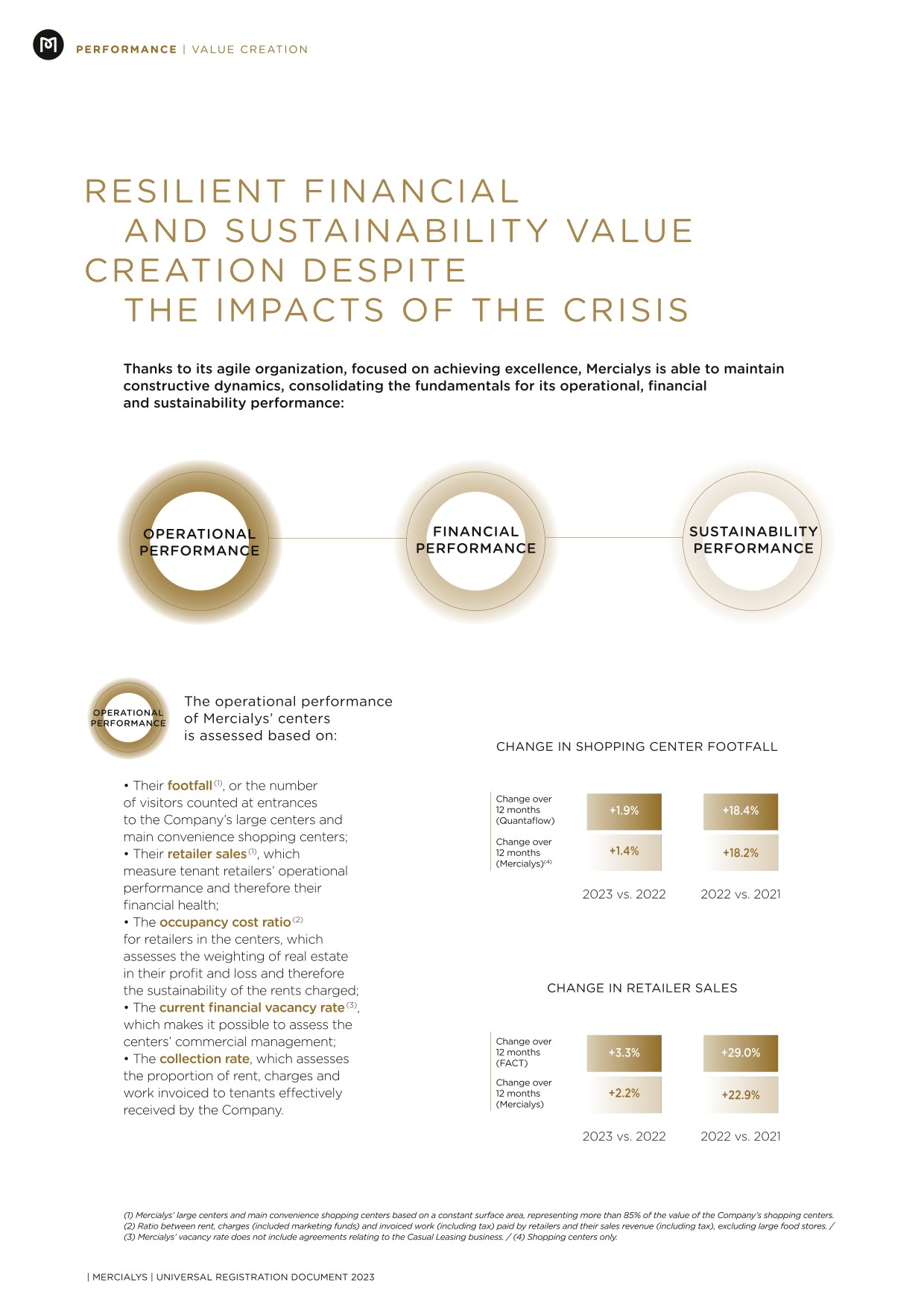

Footfall in Mercialys’ shopping centers (excluding hypermarkets) is up + 1.4% for 2023, compared with + 1.9% for the Quantaflow national index. The - 50bp performance differential with the national index was reduced throughout the year (- 140bp at end-June and - 80bp at end-September) and reflects the attractive positioning of the centers, offsetting the deceleration of the hypermarkets managed by the Casino group, which recorded a - 8.7% decline in footfall over the year.

From October 15, 2023, two hypermarkets previously operated by Casino and owned by Mercialys in Le Puy (51% stake, with the remaining interest held by BNPP Real Estate) and Besançon (25% stake, with the remaining interest held by Amundi) were opened under the Intermarché banner, with clients responding positively to this banner change. The Besançon hypermarket recorded a significant increase in footfall over the last two months of the year, with + 24.9% and + 37.5% respectively in November and December, whereas its footfall had been stable for the first nine months of 2023.

Retailer sales across Mercialys’ portfolio increased by + 2.2% in 2023 compared with 2022, while the national panel (FACT) saw + 3.3% growth. The outperformance by the FACT panel, linked mainly to a very favorable base effect during the first quarter (large shopping centers had been affected by the rollout of the vaccine pass in the first quarter of 2022), was reversed during the second half of the year, reflecting the good commercial performance by Mercialys’ client retailers. An increase in the transformation rate was recorded, with the average basket for consumption at the Company’s centers continuing to progress, up + 5.2% from Euro 19.3 in 2022 to Euro 20.3 per visitor. Looking beyond the impact of inflation, this increase reflects the continued attractive positioning of Mercialys’ shopping centers through their affordable offering focused on essential needs, which is proving resilient faced with the trade-offs that consumers are being forced to make.

With the relevant positioning of Mercialys’ assets and their strong positions in their catchment areas, the current financial vacancy rate remained effectively under control at 2.9% at end-2023, similar to end-2022 and showing a significant improvement compared with the 3.3% recorded at end-June 2023. This stability of the current financial vacancy rate is particularly satisfactory considering the significant number of retailers, primarily in the textiles sector, that filed for bankruptcy or went into liquidation in 2023 in a context of the emergence from the health crisis and the withdrawal of government support measures.

Mercialys’ intense reletting activity throughout 2023, with 150 lease renewals or relettings signed, enabled it to keep the current vacancy level effectively under control at just 40bp above its all-time low of 2.5% from 2019.

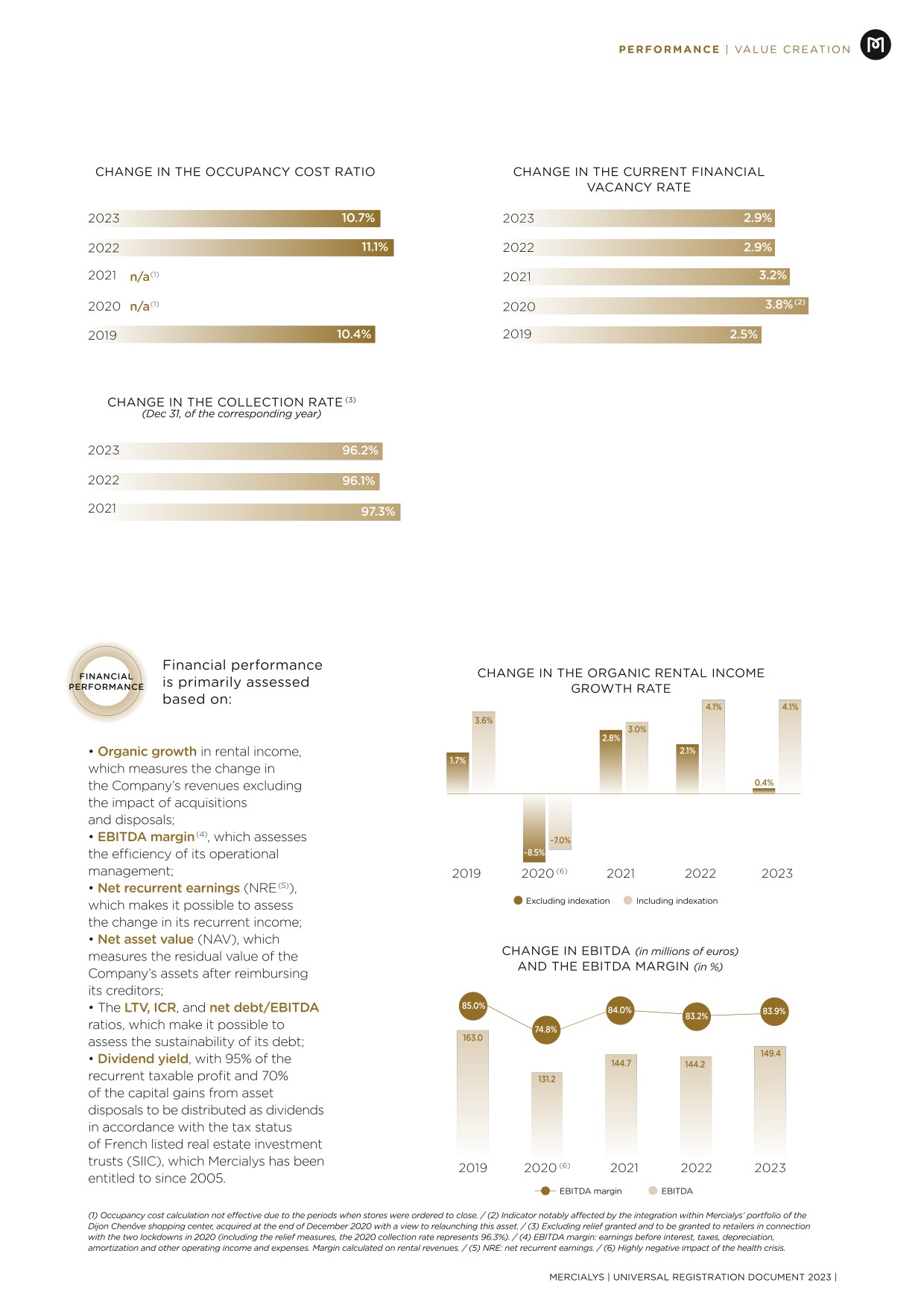

This solid operational performance is reflected in the income statement for 2023. Invoiced rents are up + 4.1% like-for-like to Euro 177.5 million. The increase in rental income on a current basis came to + 2.8%, reflecting the disposals completed in 2022. An indicator for the efficiency of the Company’s operational management, EBITDA is up + 3.6% from 2022 to Euro 149.4 million. The EBITDA margin is up + 70 bp to 83.9%, supported by rental income growth and strict control over site operating costs and overheads. Net recurrent earnings (NRE) are up + 3.3% to Euro 109.0 million, and + 3.3% per share to Euro 1.17, with this growth exceeding the target set by the Company for net recurrent earnings per share growth of at least + 2.0%. Net recurrent earnings restated in 2022 for Euro + 7.8 million of net income for various impacts relating to the health crisis, compared with Euro + 0.4 million of net income in the accounts at end-December 2023, would be up + 11.0%.

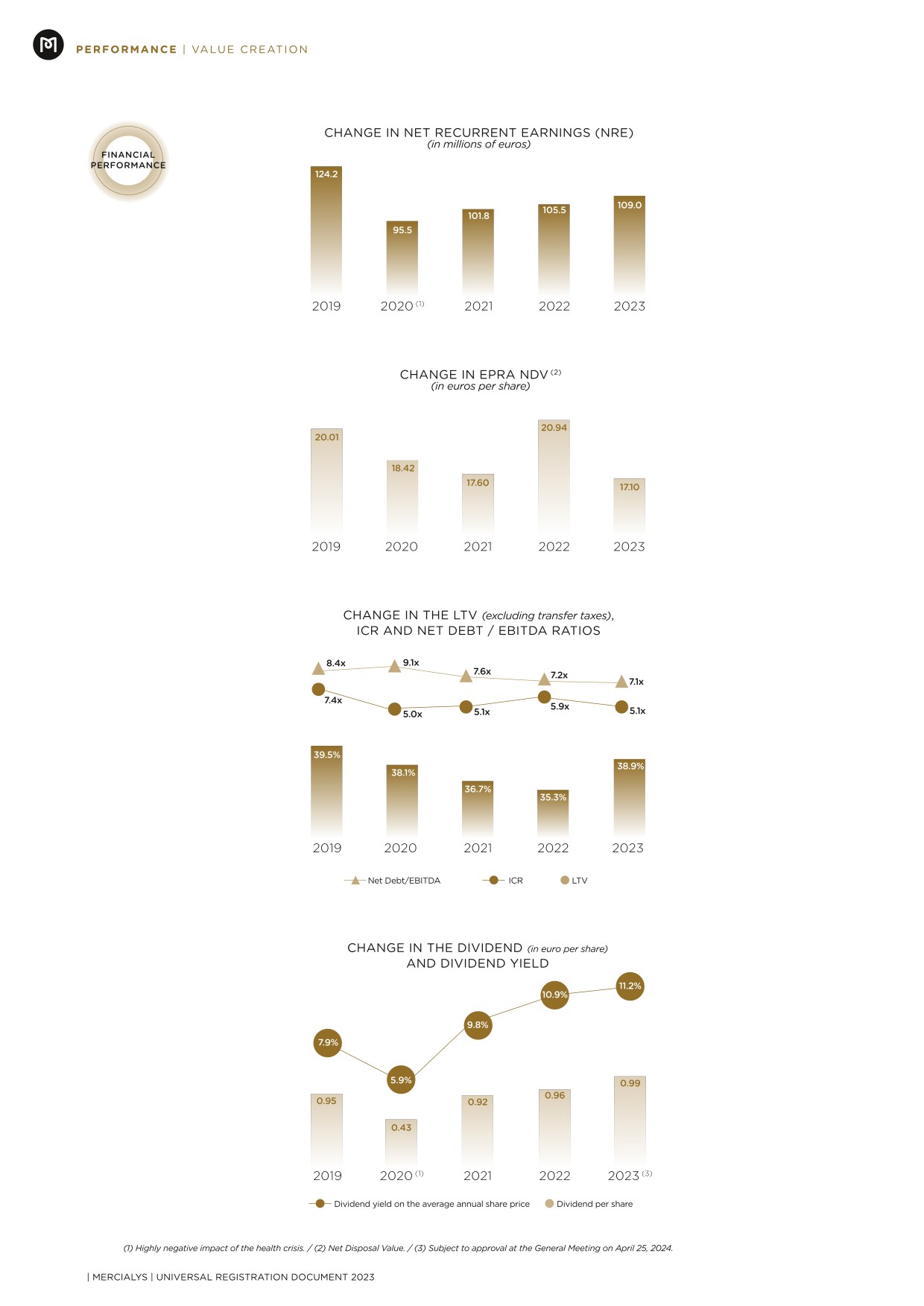

In 2023, Mercialys maintained a particularly healthy and solid financial structure, enabling it to absorb the adjustment in its portfolio’s appraisal value. The loan to value (LTV) ratio came to 38.9% at December 31, 2023, compared with 35.3% at December 31, 2022, with an ICR of 5.1x at December 31, 2023, versus 5.9x at December 31, 2022. The rating agency Standard & Poor’s acknowledged Mercialys’ robust business and sound balance sheet, confirming its BBB/stable outlook rating on October 20, 2023.

This solid financial structure offers the Company headroom for new investments, through both its project pipeline and external growth operations, as illustrated in 2023 when the Company acquired 23% of the DEPUR group and a 30% interest in ImocomPartners.

The EPRA Net Disposal Value (NDV) came to Euro 17.10 per share, down - 18.4% over 12 months and - 9.1% for the second half of 2023. It reflects a - 7.1% decrease in the value of sites over the year and the impact of the marking to market of fixed-rate debt.

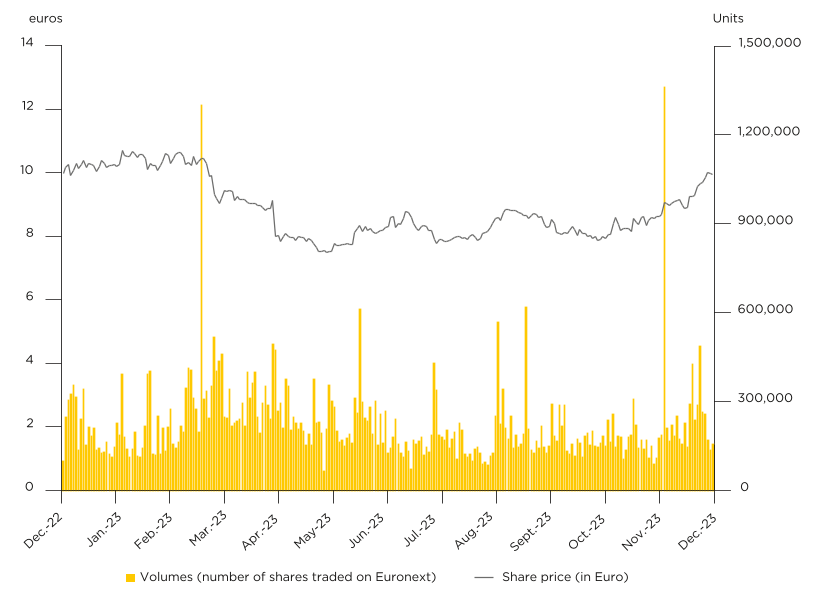

In view of all of these elements, and in line with a balanced distribution policy, the Company’s Board of Directors will submit a proposal at the General Meeting on April 25, 2024 for a dividend of Euro 0.99 per share for 2023, representing 85% of net recurrent earnings for the year, offering a yield of 5.8% on the NDV of Euro 17.10 per share at end-2023 and 9.9% on the year’s closing share price for 2023.

This proposed dividend is based on the distribution requirement with the SIIC tax status concerning exempt profits from:

- ●property rental or sub-letting operations (including dividends paid by the subsidiaries subject to the SIIC system), i.e. Euro 0.86 per share;

- ●the distribution of exempt income recorded on the Company’s balance sheet for Euro 0.13 per share.

1.1.1Mercialys is becoming the only real estate partner of all the major French food distribution networks

Realignment of the food retail landscape in France benefiting Mercialys

On December 18, 2023, the Casino group announced that it had entered exclusive negotiations with Intermarché and Auchan Retail with a view to selling virtually the entire scope of Casino group hypermarkets and supermarkets (excluding Corsica) to Groupement Les Mousquetaires and Auchan Retail. Following these exclusive negotiations, Casino announced on January 24 that it had signed agreements with Auchan Retail and Groupement Les Mousquetaires to sell 288 stores. This operation, which remains subject to approval by the competition authorities, is expected to be carried out in the second quarter of 2024, after consulting with the relevant employee representative bodies. The agreements plan for the stores to be transferred in three successive waves: on April 30, 2024, May 31, 2024 and July 1, 2024.

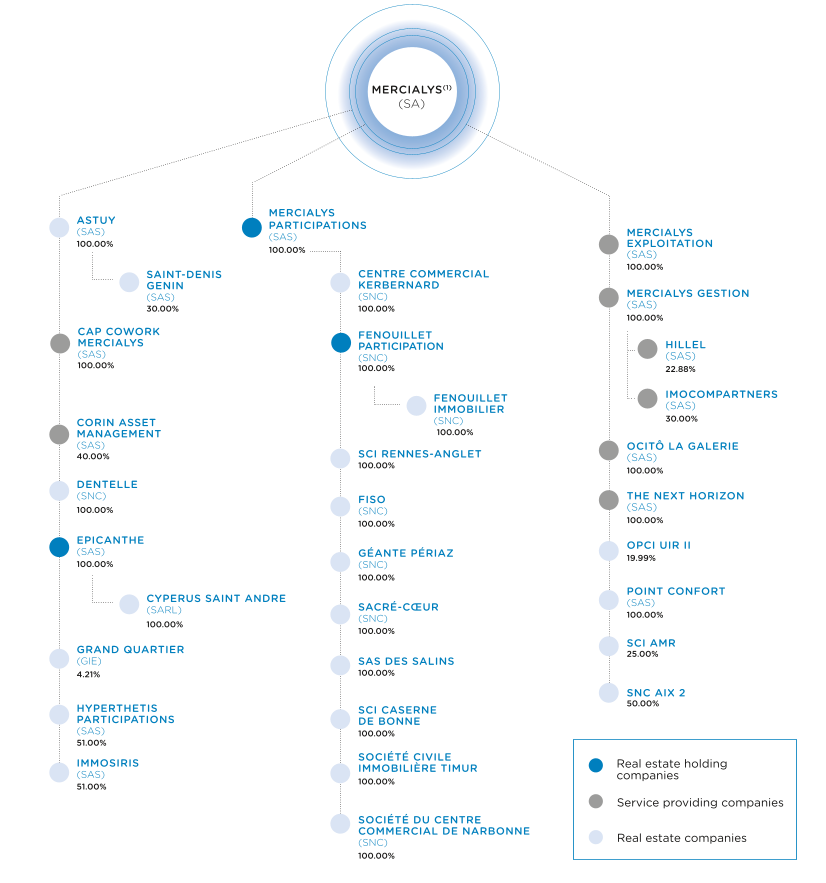

The portfolio of Casino group hypermarkets and supermarkets in Corsica, where Mercialys has a 60% stake in five Casino hypermarkets that it owns in partnership with the company Corin, was not included in this sales agreement by the Casino group.

On January 24, 2024, Carrefour also announced that it had entered exclusive negotiations with Intermarché with a view to acquiring 31 points of sale. Under the terms of this agreement, Carrefour will replace Intermarché to acquire 26 stores from Casino, with the other five stores to be acquired directly from Intermarché.

On January 25, 2024, the magazine LSA published the list of the 31 stores acquired by Carrefour, including the Lanester and Le Puy hypermarkets, owned by Mercialys.

Through this deep realignment of the retail sector in France, Mercialys, whose food anchoring was represented exclusively by the Casino group, which accounted for 20.5% of its rental income in 2023 on a consolidated basis, will become the only European retail property company to partner with all the major French food retailers.

Mercialys is once again setting out its strategic conviction to maintain significant exposure within its rental revenues to food retail, an asset class offering a foundation for recurring index-linked revenues.

- ●five food stores (including one Monoprix store) operated by Casino and fully owned by Mercialys;

- ●five food stores operated by Casino and 60% owned by Mercialys;

- ●10 food stores (nine operated by Casino and one by Intermarché since October 1, 2023) 51% owned by Mercialys (through SAS Immosiris and SAS Hyperthetis Participation, both 49% owned by BNPP Real Estate);

- ●five food stores (three operated by Monoprix, one by Casino and one by Intermarché since October 1, 2023) 25% owned by Mercialys (through SCI AMR, 75% owned by Amundi).

Taking into account the share of rental income depending on how assets are held through these various entities, Mercialys’ economic exposure to rent from retailers operated by the Casino group comes to 17.4%.

On a pro forma basis, according to information published in the press (as mentioned above and in an Article in the magazine LSA on January 22, 2024), and subject to the final breakdown of the various hypermarkets, the retailers Intermarché, Auchan and Carrefour would respectively represent 5.2%, 4.1% and 2.0% of rents on an economic basis.

This realignment will modify and considerably improve the Company’s rental risk profile. It will make it possible to replace single-tenant exposure to one struggling retailer with multi-tenant exposure to retailers that have sound financial foundations and robust commercial performance levels.

This operation will also make a significant contribution to the drive to diversify Mercialys’ rental base: the Company’s current leading tenant will represent considerably less than 10% of the rental base.

In addition, Mercialys may, in synergy with the adjoining shopping centers, support these operators to optimize their concept and format, capitalizing on its experience with asset transformation.

- ●19 of its shopping centers are currently anchored by Casino hypermarkets whose premises it does not own and which are subject to proposed food banner transfers to Intermarché and Auchan;

- ●Seven of its shopping centers are already anchored by hypermarkets whose premises it does not own and which are operated by retailers other than Casino: Super U in Rennes, Rodez, Montauban, Carrefour in Le Port, Saint-Benoît and Saint-Pierre (Reunion Island), RunMarket (Intermarché partner) in Sainte-Marie (Reunion Island).

Across all these sites, the attractive price positioning of Intermarché, Auchan and Carrefour will consolidate Mercialys’ retail mix, focused on affordable day-to-day products, and will support the consistency of the offering, help drive footfall in its centers and boost the retailers’ operational performances.

-

1.2Financial report

Pursuant to regulation (EC) No. 1606/2002 of July 19, 2002, the Mercialys group’s consolidated financial statements were prepared in accordance with International financial reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) as adopted by the European Union and applicable at December 31, 2021. These standards are available on the European Commission website at: https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/financial-reporting_en.

The accounting policies set out below were applied consistently to all the periods presented in the consolidated financial statements, after taking into account, or with the exception of, the new standards and interpretations described below.

1.2.1Financial statements

1.2.1.1Consolidated income statement

(in thousands of euros)

12/31/2023

12/31/2022

Rental revenues

178,010

173,277

Service charges and property tax

(51,079

)

(45,159

)

Charges and taxes billed to tenants

45,201

37,883

Net property operating expenses

(1,208

)

(69

)

Net rental income

170,924

165,932

Management, administrative and other activities income

3,078

2,846

Other income

-

424

Other expenses

(4,433

)

(6,283

)

Personnel expenses

(20,169

)

(18,690

)

Depreciation and amortization

(38,540

)

(37,729

)

Reversals of/(Allowances for) provisions

(4,774

)

(2,527

)

Other operating income

10,647

88,740

Other operating expenses

(30,915

)

(86,486

)

Operating income

85,818

106,227

Income from cash and cash equivalents

3,185

246

Gross finance costs

(38,194

)

(53,480

)

(Expenses)/ Income from net financial debt

(35,009

)

(53,234

)

Other financial income

774

1,089

Other financial expenses

(6,085

)

(3,939

)

Net financial items

(40,321

)

(56,083

)

Tax expense

(495

)

(709

)

Share of net income from associates and joint ventures

1,727

2,380

Consolidated net income

46,730

51,814

Attributable to non-controlling interests

(6,643

)

8,720

Attributable to owners of the parent

53,373

43,094

Earnings per share (1)

Net income attributable to owners of the parent (€)

0.57

0.46

Diluted net income attributable to owners of the parent (€)

0.57

0.46

- ( 1 )Based on the weighted average number of shares over the period adjusted for treasury shares.

- Undiluted weighted average number of shares in 2023 = 93,305,357 shares.

- Fully diluted weighted average number of shares in 2023 = 93,305,357 shares.

1.2.1.2Consolidated statement of financial position

Assets

(in thousands of euros)

12/31/2023

12/31/2022

Intangible assets

3,144

3,381

Property, plant and equipment other than investment property

5,825

4,743

Investment property

1,864,950

1,907,148

Right-of-use assets

10,615

10,184

Investments in associates

39,557

35,203

Other non-current assets

37,577

50,219

Deferred tax assets

1,614

1,601

Non-current assets

1,963,282

2,012,478

Trade receivables

35,936

28,557

Other current assets

31,902

31,854

Cash and cash equivalents

118,155

216,085

Investment property held for sale

1,400

0

Current assets

187,393

276,496

Assets

2,150,676

2,288,974

Equity and liabilities

(in thousands of euros)

12/31/2023

12/31/2022

Share capital

93,887

93,887

Additional paid-in capital, treasury shares and other reserves

583,337

631,246

Equity attributable to owners of the parent

677,224

725,132

Non-controlling interests

188,871

205,294

Shareholders’ equity

866,095

930,426

Non-current provisions

1,406

1,225

Non-current financial liabilities

1,131,627

1,131,974

Deposits and guarantees

24,935

23,622

Non-current lease liabilities

9,529

9,409

Other non-current liabilities

4,834

2,377

Non-current liabilities

1,172,332

1,168,607

Trade payables

9,265

13,910

Current financial liabilities

53,037

126,353

Current lease liabilities

1,331

1,084

Current provisions

15,581

13,279

Other current liabilities

32,940

35,237

Current tax liabilities

95

78

Current liabilities

112,249

189,941

Total equity and liabilities

2,150,676

2,288,974

1.2.1.3Consolidated cash flow statement

(in thousands of euros)

12/31/2023

12/31/2022

Net income attributable to owners of the parent

53,373

43,094

Non-controlling interests

(6,643

)

8,720

Consolidated net income

46,730

51,814

Depreciation, amortization (1) and provisions, net of reversals

64,054

46,161

Calculated expenses/(income) relating to stock options and similar

763

773

Other calculated expenses/(income) (2)

5,559

(386

)

Share of net income from associates and joint ventures

(1,727

)

(2,380

)

Dividends received from associates and joint ventures

2,525

3,065

Income from asset disposals

(766

)

(8,486

)

Expenses/(income) from net financial debt

35,009

53,234

Net financial interest in respect of lease agreements

344

321

Tax expense (including deferred tax)

495

709

Cash flow

152,987

144,825

Taxes received/(paid)

(569

)

(1,033

)

Change in working capital requirement relating to operations, excluding deposits and guarantees (3)

(19,464

)

5,816

Change in deposits and guarantees

1,313

515

Net cash flow from operating activities

134,267

150,124

Cash payments on acquisitions of:

- ●investment properties and other fixed assets

(22,532

)

(19,098

)

- ●non-current financial assets

(4

)

(43

)

Cash receipts on disposals of:

- ●investment properties and other fixed assets

3,964

81,161

- ●non-current financial assets

3,146

1,274

Investments in associates and joint ventures

(6,312

)

-

Impact of changes in scope with change of control

-

(4,292

)

Change in loans and advances granted

-

-

Net cash flow from investing activities

(21,740

)

59,002

Dividends paid to shareholders of the parent company (final)

(89,565

)

(86,025

)

Dividends paid to shareholders of the parent company (interim)

-

-

Dividends paid to non-controlling interests

(9,780

)

(5,437

)

Capital increase and reduction

-

-

Other transactions with shareholders

-

-

Changes in treasury shares

(744

)

(439

)

Increase in borrowings and financial debt

109,000

754,809

Decrease in borrowings and financial debt

(192,204

)

(880,222

)

Repayment of lease liabilities

(1,231

)

(1,398

)

Interest received (4)

17,880

20,999

Interest paid

(43,727

)

(52,484

)

Net cash flow from financing activities

(210,371

)

(250,198

)

Change in cash position

(97,844

)

(41,072

)

Net cash at beginning of year

215,999

257,071

Net cash at end of year

118,155

215,999

- ●of which cash and cash equivalents

118,155

216,085

- ●of which bank overdrafts

-

(87

)

(1) Depreciation and amortization exclude the impact of impairments on current assets.

(2) Other calculated expenses and income mainly comprise:

● discounting adjustments to construction leases

(207

)

(236

)

● lease rights received from tenants and spread over the firm term of the lease

2,920

(662

)

● deferred financial expenses

648

826

● interest on non-cash loans and other financial income and expenses

2,024

(362

)

(3) The change inworking capital requirement breaks down as follows:

● trade receivables

(7,462

)

8,392

● trade payables

(4,646

)

(2,863

)

● other receivables and payables

(7,356

)

287

Total working capital requirement

(19,464

)

5,816

(4) Primarily comprising interest received on instruments classed as debt hedging instruments in accordance with IAS 7.16

-

1.3Real estate portfolio

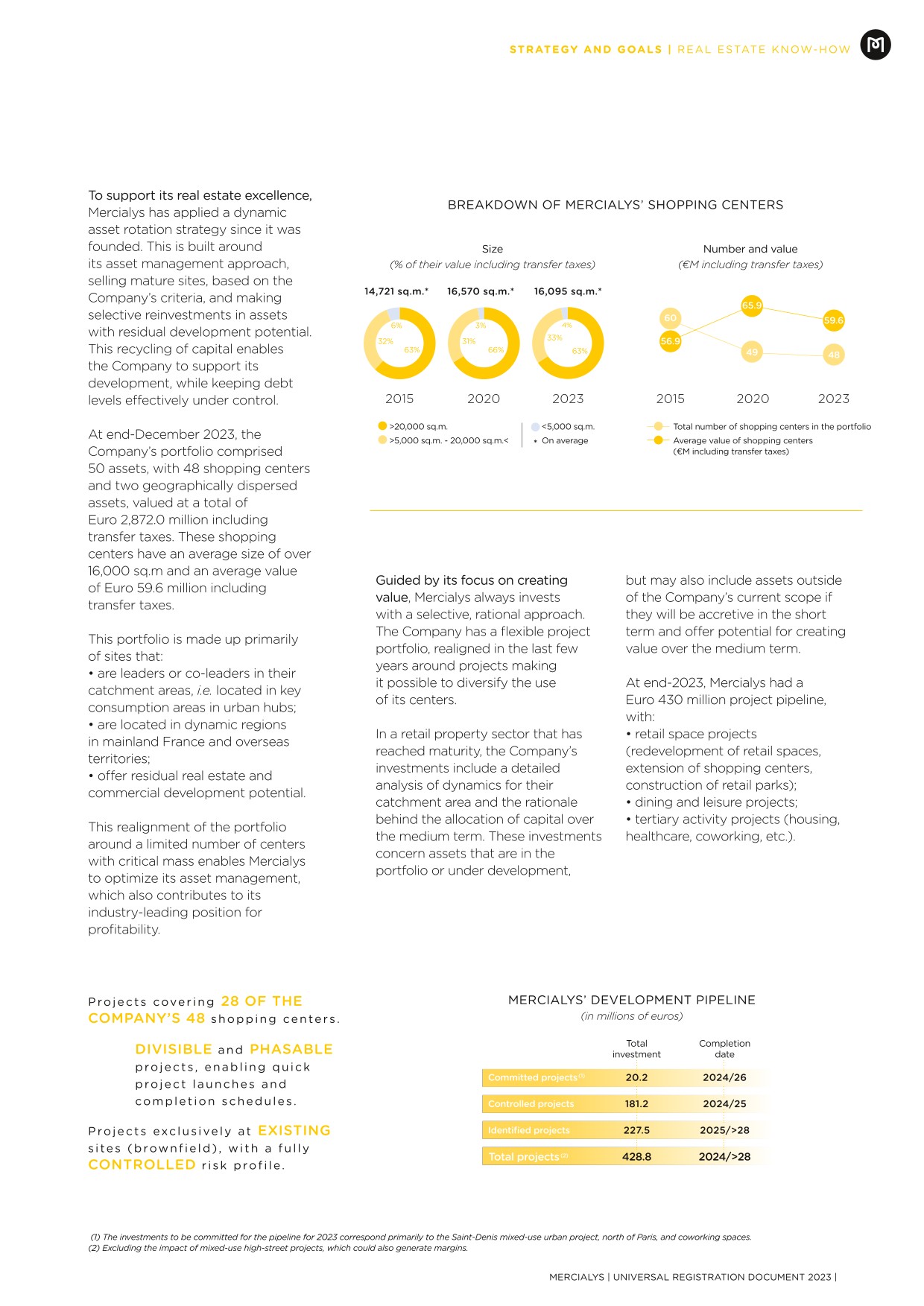

1.3.1Portfolio valued at Euro 2,872.0 million including transfer taxes at December 31, 2023

1.3.1.1Experts and methodology

The shopping centers owned by Mercialys are appraised by experts in accordance with the Royal Institution of Chartered Surveyors (RICS) Code of Ethics, appraisal and valuation standards, using the fair value appraisal methods recommended by the 1998 Property Appraisal and Valuation Charter and the 2000 report published by the joint working group of the Commission des Opérations de Bourse (COB) and the Conseil National de la Comptabilité (CNC) on property asset valuations for listed companies.

Mercialys also complies with the Code of Ethics for French REITs (Sociétés d’Investissement Immobilier Cotées - SIIC) in terms of the rotation of appraisers.

In accordance with the AMF recommendations concerning the rotation of real estate appraisers, Mercialys launched a call for tenders in 2022 covering 83% of the assets to be valued.

This call for tenders led to a rotation for 48% of the assets concerned (i.e. 40% of the assets to be valued). The new appraisers began their work during the first half of 2023. The appraisers’ fees are determined based on the number and size of the assets to be valued when signing the three-year contract.

All of the assets in Mercialys’ portfolio have been valued, with those undergoing full appraisals subject to town planning surveys, market and competition studies, and site visits. In accordance with the 2000 COB/CNC report, two methods have been used to determine the fair value of each asset:

- ●first, the capitalization of income method, which involves taking the rental income generated by the asset and dividing it by a yield rate for similar assets, taking into account the actual rent level versus market levels;

- ●second, the discounted cash flow (DCF) method, which takes account of expected annual changes in rental incomes, vacancies, and other factors such as expected letting periods and the investment expenses covered by the lessor.

The discount rate used takes into account the market risk-free rate (TEC 10-year OAT), plus a risk premium and a real estate market liquidity premium, as well as potential risk premiums for obsolescence and rental risk.

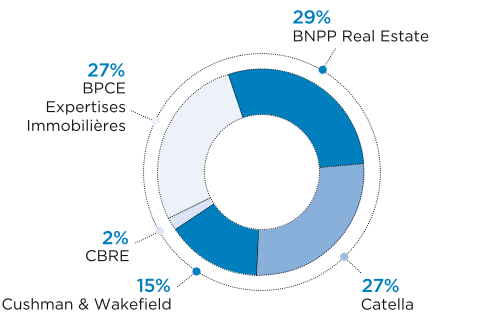

Five independent appraisers performed the appraisals of Mercialys’ portfolio at June 30, 2023 and December 31, 2023: BNPP Real Estate Valuation, BPCE Expertises Immobilières, Catella Valuation, Cushman & Wakefield Valuation and CBRE Valuation.

Breakdown of valuations per expert

Mercialys’ portfolio value came to Euro 2,872.0 million including transfer taxes, down - 3.8% over six months and - 7.1% over 12 months. Like-for-like Sites on a constant scope and a constant surface area basis.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(16), it is down - 3.7% over six months and - 7.0% over 12 months.

Excluding transfer taxes, the portfolio value was Euro 2,692.3 million, down - 3.8% over six months and - 7.1% over 12 months. Like-for-like (1), it is down - 3.7% over six months and - 7.0% over 12 months.

The average appraisal yield rate was 6.61% at December 31, 2023, compared with 5.75% at December 31, 2022 and 6.21% at June 30, 2023. This decompression of the appraisal rates by 40bp during the second half of the year and 86bp over the full year reflects the context of rising interest rates between 2022 and 2023, as well as an overall increase in the risk premium recognized by the appraisers across the real estate sector in general and specifically for Mercialys, with this risk considered to be higher with regard to the sustainability of rental income from the Casino group, before the completion of the restructuring process. However, the economic and financial assumptions retained by the appraisers do not show any fundamental changes from year to year, reflecting the strong position of the Company’s sites, illustrated by a low vacancy rate and the positive indexation.

Note that the valuation of Mercialys’ portfolio is determined on the basis of a “sum of the parts” approach. In other words, the total valuation is equal to the sum of the individual valuations of each asset, whether this is determined using the capitalization of income method or the DCF approach.

The valuation of each asset presents its own underlying assumptions in terms of rental growth, investment, capitalization and discount rates.

This makes it difficult to reconstruct underlying average valuation assumptions at consolidated level. Matters are further complicated by the fact that appraisers do not always use strictly identical valuation methodologies, and the weighting criteria used when compiling the underlying assumptions for individual valuations may cause the results to vary significantly.

In the interests of transparency and accuracy, Mercialys approached its two main real estate experts, BNP Paribas Real Estate and BPCE Expertises Immobilières, for guidance on this point. These companies, which respectively appraise 29% and 27% of Mercialys’ assets by number, stated that they applied a compound annual growth rate (CAGR) of net rental income including indexation of + 2.7% for BNPP and + 3.3% for BPCE between 2024 and 2033.

1.3.1.2Real estate appraisal report prepared by Mercialys’ independent valuers

Introduction

- ●BNPP Real Estate Valuation;

- ●Catella Valuation;

- ●CB Richard Ellis Valuation;

- ●Cushman & Wakefield Valuation;

- ●BPCE Expertises Immobilières.

Number of assets

Potential rent

Fair value excluding transfer taxes

Fair value including transfer taxes

BNPP Real Estate Valuation

17

€98.5m

€1,553.9m

€1,655.1m

Cushman & Wakefield

9

€16.4m

€196.3m

€209.8m

Catella Valuation

16

€19.1m

€188.5m

€201.6m

CB Richard Elis Valuation

1

€8.0m

€118.0m

€126.0m

BPCE Expertises Immobilières

16

€54.5m

€712.6m

€761.9m

of which undivided share

€6.7m

€77.0m

€82.4m

BPCE Expertises Immobilières

16

€47.9m

€635.6m

€679.6m

Total

59

€189.8m

€2,692.3m

€2,872.0m

General background to the appraisal

Background and instructions

In accordance with the instructions given by Mercialys (the “Company”), set out in the valuation contracts signed between Mercialys and the Appraisers, we have estimated the value of the assets owned by the Company reflecting the manner in which they are owned (full ownership, construction lease, etc.). This condensed report, which summarizes the conditions for our work, has been written in order to be included in the Company’s Registration Document. The appraisals were conducted locally by our expert teams and were reviewed by the pan-European teams of Appraisers. To determine the market value for each asset, we considered real estate transactions at European level, as well as domestic transactions. We confirm that our opinion of market value has been revised in light of other appraisals carried out in Europe, so as to ensure a consistent approach and to take into account all transactions and information available on the market. The valuations are based on the discounted cash flow method or the yield method, which are regularly used for assets of this kind.

Standards and general principles

We confirm that our valuations were conducted in accordance with the corresponding sections of the Code of Conduct from the 8th Edition of the RICS Valuation Standards (the “Red Book”). This is an internationally accepted basis of appraisal. Our valuations comply with IFRS accounting standards and the standards and recommendations published by the IVSC. The appraisals were also prepared in light of the AMF’s recommendations concerning the presentation of valuations of listed companies’ real estate portfolios, published on February 8, 2010. They also take into account the recommendations made in the Barthès de Ruyter report on the valuation of the real estate portfolios of listed companies, published in February 2000. We certify that we prepared our appraisal as independent external appraisers, as defined in the standards from the Red Book published by RICS.

Target value

Our valuations correspond to market values and were presented to the Company in terms of value excluding rights (after deducting transfer duties and costs) and including rights (market value before any deduction of transfer duties and costs).

Conditions

Information

We asked the Company’s management to confirm that the information provided to us relating to the assets and tenants is complete and accurate in all material respects. Consequently, we considered that all of the information known to the Company’s employees and which could affect the value, such as operating expenses, work undertaken, financial items including doubtful receivables, variable rents, current and signed lettings, rent-free periods, as well as the list of leases and vacant units was made available to us and is up to date in all material respects.

Surface area of assets

Environmental analyses and soil conditions

We were not asked to perform a study of soil conditions or an environmental analysis and we did not investigate past events to determine whether the soil or structures of the assets are, or have been, contaminated. Unless indicated otherwise, we assumed that assets are not, and should not be, affected by soil contamination and that the condition of the land does not affect their current or future use.

Urban planning

We did not study the building permits and assume that the properties have been built and are occupied and used in compliance with all necessary authorizations and are free of any legal recourse. We assumed that the assets comply with legal requirements and urban planning regulations, particularly as regards structural, fire, health and safety regulations. We also assumed that any extensions currently under construction comply with urban planning regulations and that all the necessary authorizations have been obtained.

Land titles and rental status

We have based our assessments on the rental position, summaries of additional revenues, non-recoverable charges, capital projects and the business plans provided to us. In addition to what is already mentioned in our reports for each asset, we assumed that ownership of the assets is not subject to any restrictions that would prevent or hinder their sale, and that they are free of any restrictions and encumbrances. We did not read the land titles for the assets and we accepted the rental and occupancy statements or any other relevant information communicated to us by the Company.

Condition of the assets

We noted the general condition of each asset during our visits. Our assignment does not include technical aspects concerning the structure of buildings. However, we indicated in our report any signs of poor maintenance observed during our visit, if applicable. The assets were appraised on the basis of information provided by the Company, according to which no hazardous materials have been used in their construction.

Taxation

Our valuations do not take account of any costs or taxes that may be incurred in the event of an asset being sold. The rental and market values provided do not include value added tax.

Confidentiality and publication

Lastly, in keeping with our usual practices, we confirm that our appraisal reports are confidential and intended solely for the Company. No liability is accepted in relation to third parties, and neither the appraisal reports as a whole nor extracts from these reports may be published in a document, declaration, circular or communication with third parties without our written agreement, covering both the form and content in which they may appear. In signing this Condensed Report, each expert does so on their own behalf and exclusively for their own expert appraisal work.

-

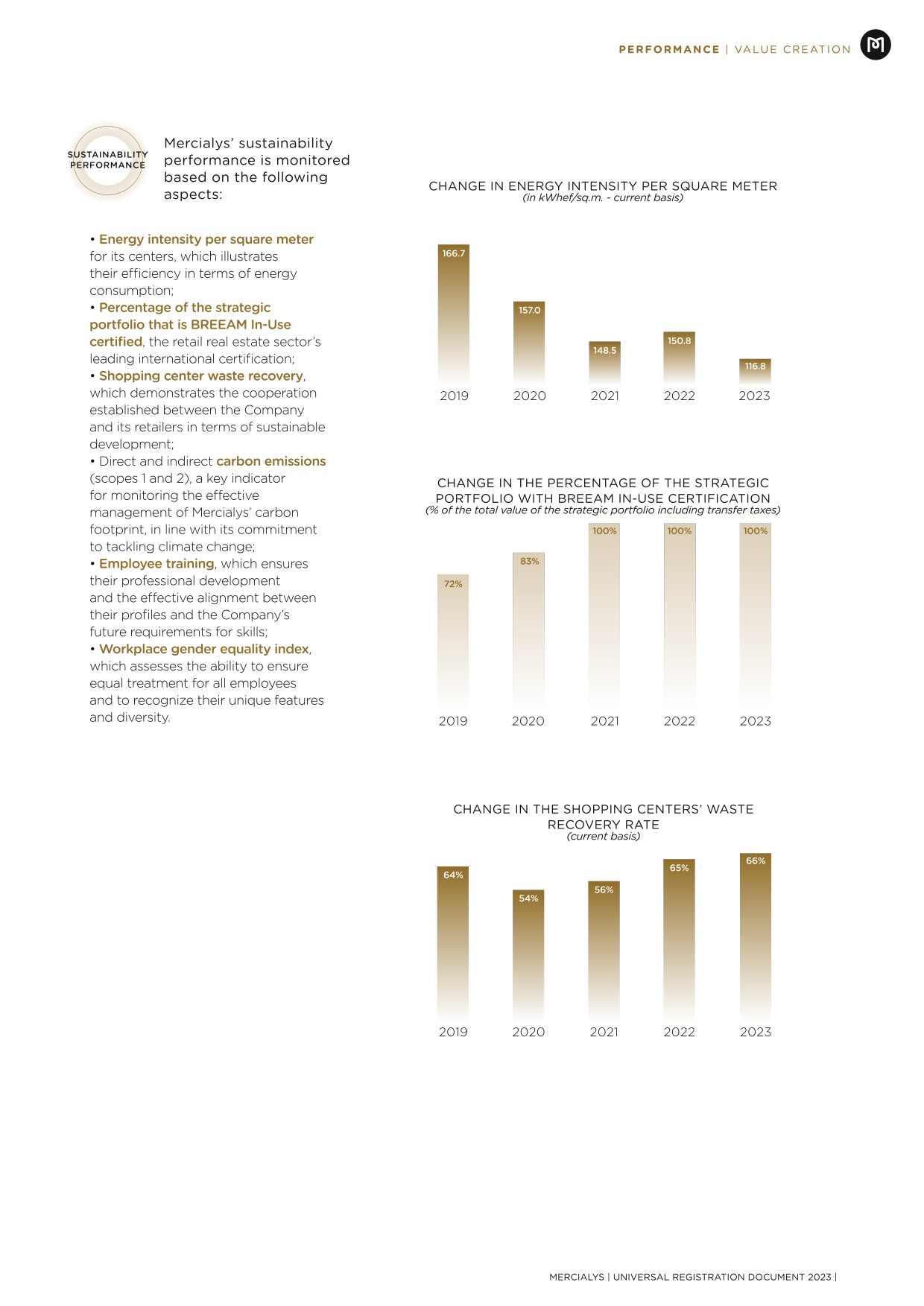

Corporate Social Responsibility

Mercialys firmly believes that the consideration of environmental, societal and social issues is a major differentiating factor. It has made this an integral part of its corporate strategy. This is reflected in the day-to-day implementation of responsible and ethical management of all its owned and managed assets. This chapter sets out in detail its strategic Corporate Social Responsibility (CSR) projects, its policies and action plans implemented, as well as its results.

2.1Non-financial risks and opportunities covered by Mercialys’ CSR strategy

2.1.1CSR governance designed to effectively manage risks and opportunities and ensure the successful implementation of the strategy

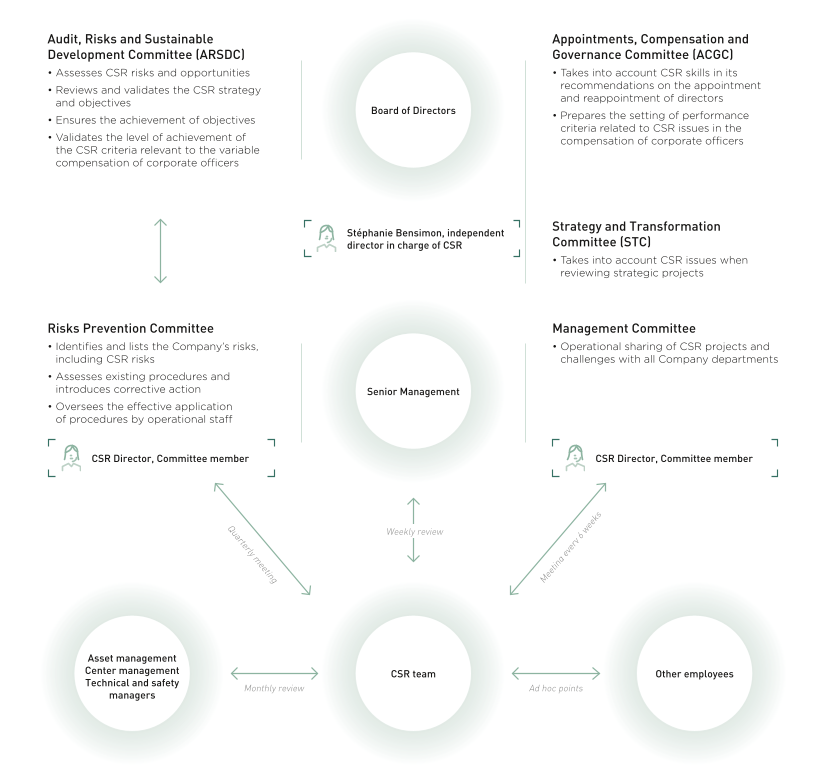

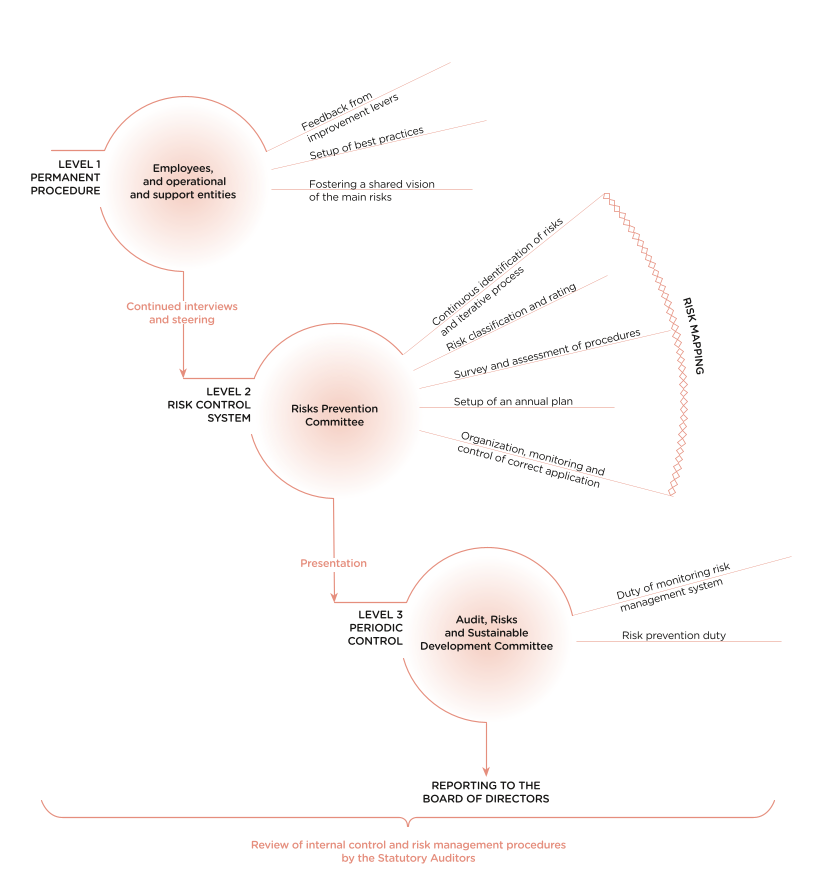

The management of CSR risks is an integral part of Mercialys’ risk management process. Indeed, the Risks Prevention Committee (RPC) is composed of the Chief Executive Officer, the Deputy Chief Executive Officer, the Director of Human Resources, the Head of Internal Control, the CSR Director and the Ethics and Compliance Director. This RPC is responsible for:

- 1 .identifying the risks to which Mercialys is exposed;

- 2 .identifying and assessing existing procedures;

- 3 .implementing a plan to supplement and optimize risk management;

- 4 .organizing the oversight and proper application of procedures.

The 52 risks identified by the RPC are divided into 8 categories, one of which is dedicated to environmental, social and societal risks. All risks are then assessed annually according to their impact and probability of occurrence. Probability of occurrence assesses the possibility that a risk will materialize at least once, in the short, medium and/or long term. The impact quantifies possible consequences, either in terms of the Company’s financial position (change in operating results or Net Asset Value), or obstacles to the ongoing implementation of the Company’s strategy or operations, or its reputation (importance given by stakeholders or media impact). CSR risks were assessed using this scale, using the results of the stakeholder consultation conducted upstream.

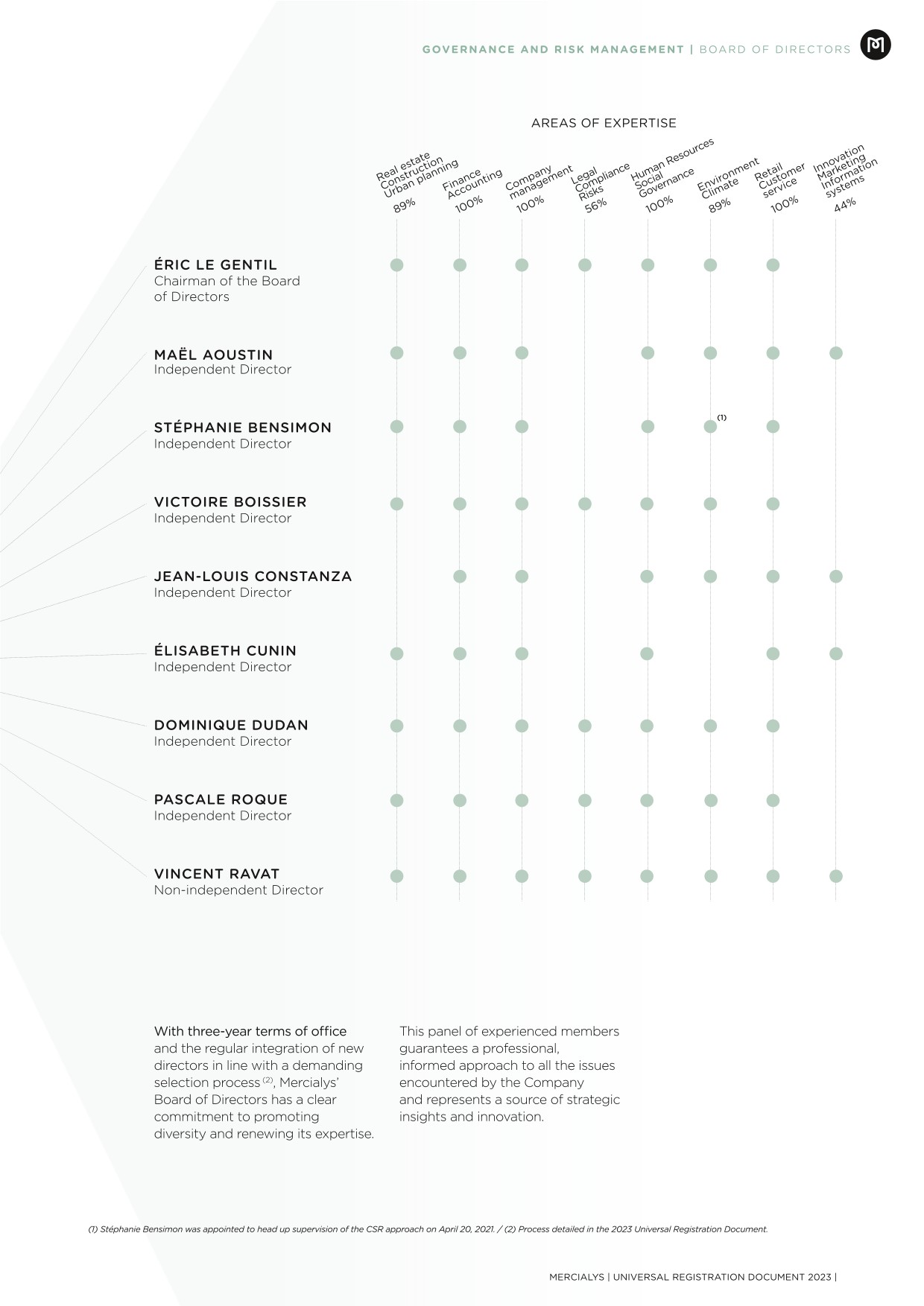

Each year, the RPC reports on its work to the Audit, Risks and Sustainable Development Committee (ARSDC) and the Management Committee. The Board of Directors as a whole is also regularly updated on the progress of the CSR strategy and has approved the Company's carbon strategy. Directors have access to the expertise of Mercialys’ teams and sustainability rating agencies. They can also benefit from training or awareness-raising tools on CSR issues. Taking things one step further in 2023, Mercialys’ directors underwent two training sessions on CSR. The first combined theoretical e-learning training on the causes and effects of climate change with a face-to-face session on climate change adaptation and mitigation with a case study tailored to retail real estate. The second, delivered face-to-face, focused on CSR in the real estate sector. They were attended by all directors.

To prevent, mitigate and reduce CSR risks while managing the objectives of its CSR strategy 4 Fair Impacts for 2030 presented in the table in § 2.1.2, the Company has set up a dedicated governance. It is cross-functional, in conjunction with the operational departments at Company level and broken down by asset.

Supervising cross-functional projects

Mercialys' CSR team defines and implements the Company’s CSR strategy. This department reports to the Deputy Chief Executive Officer, proof of the integration of CSR issues at the heart of the Company’s strategy. Human Resources development issues such as the implementation of Mercialys’ diversity and inclusion policy are the responsibility of the Human Resources Department. The Management Committee, of which the CSR Director and Director of Human Resources are members, shares information on the operational implementation of the CSR strategy and its state of progress with all of the Company’s departments.

The CSR strategy, risks and opportunities are regularly assessed, validated and reviewed by the Company’s various governance bodies. The Board of Directors is kept informed of the implementation of the CSR strategy and the achievement of the associated criteria at least annually and oversees the management of CSR issues by the Company through its three specialized committees:

- ●the ARSDC assesses the CSR risks and opportunities, reviews and validates the CSR strategy and verifies its progress once or twice a year. The Chairwoman of the ARSDC has been appointed responsible for monitoring the CSR approach;

- ●the Strategy and Transformation Committee (STC) takes CSR aspects into account when reviewing strategic projects;

- ●the Appointments, Compensation and Governance Committee (ACGC) prepares the setting of performance criteria related to climate and nature-related issues within the context of Senior Management compensation.

For more details on the roles of the various bodies and their interactions, see Chapter 5, § 5.1.1, p. 320 et seq. and the diagram below.

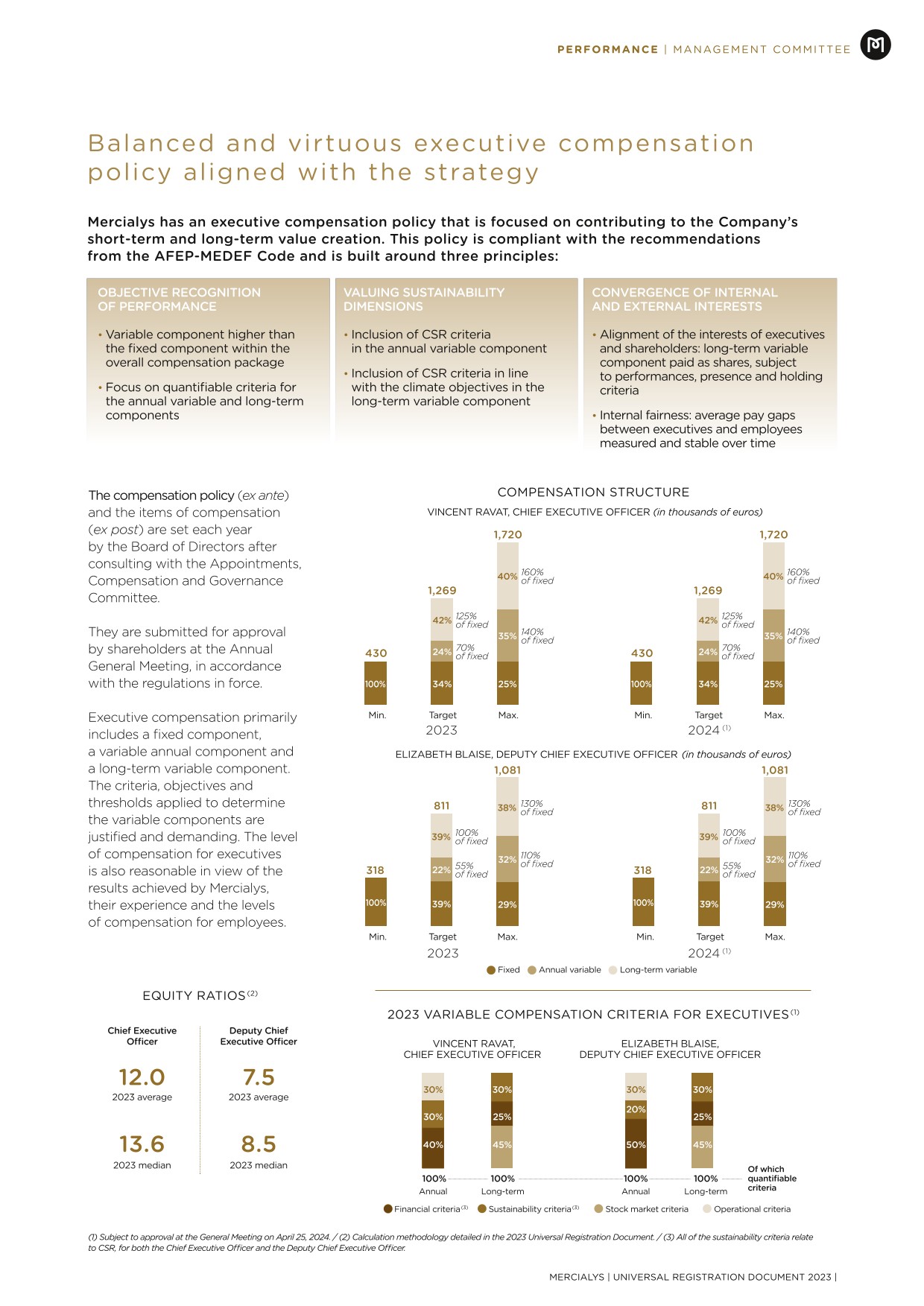

The Company’s executive corporate officers have 20% of their annual variable compensation indexed to the Company’s CSR performance. One of their three equally-weighted long-term compensation objectives is systematically also a CSR objective. One of the two CSR criteria for the Chief Executive Officer and the Deputy Chief Executive Officer for 2023 concerns the “greening” of financing and the achievement of the associated CSR objectives, including that related to the Company’s carbon roadmap. For more information, see Chapter 4, § 4.2.2, p. 272 et seq.

As all Mercialys employees are involved in the successful implementation of this strategy, they all also have an individual CSR objective in their annual variable compensation. It represents at least 10% of their annual bonus, is specific to their roles, and is quantitative for senior staff and qualitative for other categories of employees.

Again with a view to involving as many stakeholders as possible, Mercialys is continuing to green its financing structure. Two major criteria of Mercialys’ CSR strategy have been selected to support 6 bank credit lines, for a total amount of Euro 385 million. The margins of these credit lines are indexed to the BREEAM In-Use certified share of the strategic portfolio and the achievement of scope 1 and 2 greenhouse gas emissions reduction targets. The Company benefits from a reduction in the margin in the event of compliance with these two commitments. Otherwise, an increase in this margin is applied. Until now, Mercialys has benefited from this reduction in its margins thanks to the achievement of its ESG (environmental, social and governance) objectives. In 2023, the Company signed a new credit line incorporating these criteria, taking its approach one step further. It includes target scores for the BREEAM In-Use certification, targets related to its scope 1 and 2 carbon roadmap, and to scope 3 for its operational waste management.

Acting at the asset level

In order to steer the CSR strategy at asset level, the Company’s 4 Fair Impacts for 2030 objectives have been broken down by asset, to be relevant to the operational reality. In order to plan the actions to be implemented to achieve these objectives, to phase them in over time, to forecast the budgets to be allocated and to monitor them, CSR roadmaps have been drawn up for each center. They were developed jointly by the Asset Management Department, the Center Management Department, the property manager, and the CSR team. They are adapted to the specificities of each site. In addition, during the annual reviews of the business plan by asset, the center directors and asset managers present the progress of the 4 Fair Impacts for 2030 CSR strategy to Senior Management.

To ensure their implementation and to detect any malfunctions as early as possible, a dedicated IT tool facilitates the monitoring, analysis and steering of key CSR performance indicators. It is accessible to all relevant departments as well as to external property managers. In addition, monthly meetings for each geographical area are attended by the property manager and the asset management, center management and CSR departments. They enable the analysis of key performance indicators on energy and water consumption, as well as waste recovery out at the centers. These meetings make it possible to compare assets using different analysis criteria: in absolute value, in relative value compared to activity data, and between centers in the same geographical area, compared to the previous period. Some of the operating problems of the centers are thus identified, enabling them to be corrected quickly, while sharing the best practices already implemented.

Furthermore, other tools have been developed by department to address Mercialys’ CSR expectations accordingly. For example, the Center Management Department monitors and analyzes the centers' environmental performance on a monthly basis, and the Technical Department checks that the “construction and maintenance specifications” are properly adhered to while work is carried out.

CSR governance

-

2.2For our environment

Because the construction sector generates 23% of French greenhouse gas emissionsSource: French Ministry for the Energy Transition, September 2020.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(3) and global warming represents physical and transition risks for Mercialys’ portfolio, the real estate company is committed to contributing to carbon neutrality by:

- ●pursuing a very ambitious policy to reduce greenhouse gas emissions validated by the Science Based Targets initiative (SBTi);

- ●reducing the pressure that the Company exerts on natural resources.

2.2.1Aim for net zero carbon emissions

The effects of climate change are also being observed in France, with 2023 being particularly marked by extreme climate events including record heat waves, forest fires, floods and violent storms. Taking action to mitigate climate change and adapting its assets and their operation accordingly are key challenges for Mercialys and all other economic players. Mercialys’ Risks Prevention Committee (RPC) has identified and characterized the Company’s risks and opportunities associated with the effects of climate change. It is also transparent about its climate risks, in accordance with the 11 recommendations of the international working group Task Force on Climate-related Financial Disclosure (TCFD) (see p. 119 et seq.) and by responding publicly each year to the Carbon Disclosure Project (CDP) since 2017.

Adapting to the effects of climate change

In order to ensure the resilience of its portfolio, particularly regarding the physical consequences of climate change, Mercialys has identified the climate risks most likely to affect its assets. Within the framework of its RPC, the Company has mapped the natural risks facing its assets: flooding, forest fires, risk of marine submersion, landslides, clay swelling, mining, seismic activity, and avalanches. 60% of its assets are affected by a Natural Risk Prevention Plan (PPRN), of which 4% have prescribed work on existing projects as part of the Flood Risk Prevention Plans (PPRI).

Taking things one step further, Mercialys carries out detailed studies, asset by asset, on the priority physical hazards and transition risks related to climate change to which it is exposed now or may be in the future, as well as the vulnerability and resilience of its assets to these hazards. These studies comply with the criteria defined in Appendix A of Regulation (EU) 2020/852, known as the Taxonomy Regulation (see Appendix 1 p. 110). The Company has thus assessed the risks of 62% of its portfolio, among the following hazards: heat waves, drought, clay shrinkage and swelling, forest fires, average rise in temperatures, floods/rainfall, storms, marine submersion, coastal erosion, earthquakes and landslides. Different timeframes and scenarios were used to carry out these analyses: at 30 and 50 years to be adapted to the life of a building, and the RCP 4.5 and RCP 8.5 scenarios of the Intergovernmental Panel on Climate Change (IPCC). These are the scenarios corresponding respectively to the implementation of measures to stabilize greenhouse gas emissions, and to the most unfavorable scenario without a climate policy.

It shows that Mercialys’ assets are mainly affected by heat waves, average temperature rise and drought. The significant challenges therefore notably relate to the insulation of buildings and the heating and air conditioning systems of the Company’s assets, as well as monitoring the structure of buildings. The Company is also investigating various measures to adapt to rising temperatures and heat waves. For example, it has applied a white coating, called cool roof, to the roofs of some of its shopping centers. This helps to reflect sunlight and thus improve the thermal comfort inside the building.

Mercialys is gradually extending these analyses to cover its entire portfolio and implement action plans to prevent priority risks.

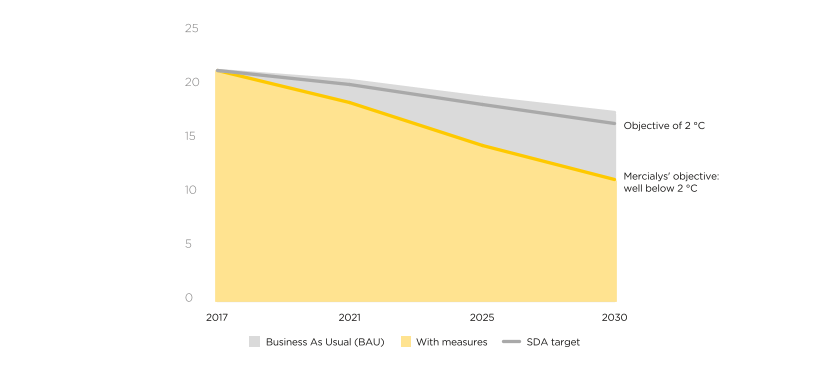

Contribute to mitigating climate change with a scientifically-validated carbon roadmap

Through its carbon roadmap validated by the Science Based Targets initiative (SBTi) since 2019, the Company is directly involved in the Paris Climate Agreement. It contributes to the collective effort to limit the average rise in global temperatures to well below 2 °C compared to pre-industrial temperatures.

In order to define its objectives to fight climate change submitted to the Science Based Targets initiative (SBTi), Mercialys studied three scenarios, over several timeframes between 2022 (5 years) and 2050:

- ●the “Business-as-Usual” (BAU) scenario, estimating the change in Mercialys’ emissions if its efforts remained at the level of the time;

- ●the “Sectoral Decarbonization Approach” (SDA) scenario of the real estate sector, making it possible to remain below a 2 °C increase (RCP 2.6 scenario of the IPCC Fifth Assessment Report);

- ●the scenario chosen by Mercialys, which leads to measures to reduce the emissions identified by the Company and limits the increase in global temperatures to “well below 2 °C” (the most ambitious category at that time)When Mercialys submitted its carbon roadmap, the 1.5 °C category had not yet been launched by the SBTi (Science Based Targets initiative).</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(4).

Mercialys carbon roadmap validated by the SBTi

Aware that the fight against climate change goes beyond its scope of direct responsibility, Mercialys has set itself targets both for the energy consumption of the parts of its assets under its direct management and for refrigerant leaks from its air conditioning systems (scopes 1 and 2), as well as its carbon footprint extended to third-party stakeholders (scope 3). As such, Mercialys’ climate strategy is based on four objectives covering the period between 2017 and 2030:

- ●reducing scope 1 and 2 emissions by 47% per sq.m. using the market-based methodMarket-based: method used to calculate CO2 from energy consumption, which makes it possible to take into account energy suppliers’ emission factors and to highlight the renewable energy purchase.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(5);

- ●reducing emissions from tenants’ energy consumption by 46% per sq.m.;

- ●reducing emissions from employee travel by 26%;

- ●reducing emissions related to the treatment of waste produced by the centers by 26% per metric ton of waste produced.

The Science Based Targets initiative approved these objectives in 2019, making Mercialys one of the first real estate companies in the world to have its objectives scientifically approved. Mercialys plans to review its carbon roadmap in order to align it with current best practices.

In addition, Mercialys has included commitments to reduce its scope 1, 2 and 3 greenhouse gas emissions in its credit lines, and is thus gradually greening its debt (see page 81).

Through its 4 Fair Impacts CSR strategy, Mercialys is reaffirming its contribution to the fight against climate change by setting itself ambitious objectives, beyond those already established and approved by the SBTi. Indeed, Mercialys aims to contribute to carbon neutrality by 2030, across all its emissions (scopes 1, 2 and 3).

Continuing its actions on scopes 1 and 2

In order to achieve its 2030 objectives for scopes 1 and 2, Mercialys’ strategy is based on four areas:

- ●the modeling of shopping centers’ energy consumption, free from the impact of unexpected events (e.g. a breakdown) and influencing factors (e.g. weather, occupancy), is used to identify optimization measures and investments required to improve assets’ energy performance. All Mercialys assets have been the subject to such a study;

- ●the deployment of remote-read energy and water sub-meters at 73% of sites, with an additional 8% planned. They enable the real-time measurement of the energy and water consumption of the sites by use. This system also makes it possible to analyze consumption by cross-referencing it with activity data such as shopping center opening hours and footfall. Alerts are automatically sent in the event of abnormal water consumption so that certain management anomalies can be quickly corrected. This alert system is being rolled out for energy consumption;

- ●facilities management and supervision through building technical management systems at 93% of Mercialys’ assets to regulate temperatures and the operating time slots of the facilities, among other things. In order to anticipate tensions on the energy market, Mercialys implemented an energy sobriety plan in the autumn of 2022, to contribute to the national effort to save energy and determine and test the procedures in the event of power outage. The Company has thus rolled out concrete actions in its shopping centers, including:

- ●lowering heating and air conditioning temperatures to 17°C in winter and 26°C in summer,

- ●limiting heating at night to the bare minimum,

- ●switching off of general lighting and signs one hour after the last store closes,

- ●adjusting the air flow rates of ventilation systems,

- ●shutting down hot water tanks,

- ●using of 100% LED Christmas decorations,

- ●lighting Christmas decorations from 11 a.m. indoors and 4 p.m. outdoors,

- ●reducing the light intensity of advertising screens and large display walls.

- This plan led to an average energy saving of 25% in the winter of 2022/2023 compared to the previous winter.

- In order to perpetuate these actions, in 2023 Mercialys signed the Charter for the Energy Efficiency of Tertiary Buildings, initiated by the French Sustainable Building Plan and ADEME.

- ●multi-year work plans for the installation of energy-efficient equipment, such as the replacement of aging installations, or LED relamping for lighting. Over the past three years, 52% of sites have undergone such work. As proof of the rapid effectiveness of the work to switch the LED lighting in La Galerie Quimper shopping center in 2021, the energy consumption required for this item was halved compared to the previous year;

- ●improving the insulation of its sites, in particular by taking advantage of the repair of the waterproofing of its sites to improve the overall insulation performance of the building;

All these actions have made it possible to further reduce each year the energy consumption per square meter of the Company’s shopping centers, to achieve - 33% between 2018 and 2023;

- 2 .Use less carbon-intensive energy to operate the shopping centers. Thus, in 2023, 36% of Mercialys sites were supplied with exclusively green electricity and 83% of gas-powered centers subscribed to a 100% biogas offer. Mercialys is also able to reduce its carbon footprint with the development of self-produced renewable energy. For example, in 2023, La Galerie Cap Costières in Nîmes produced and consumed 295 MWh of electricity from solar energy thanks to photovoltaic units installed around the main building. This represents 30% of this center’s consumption. The Company is preparing to launch a potential study to develop photovoltaic power plants at its centers. In addition, during replacements, the use of equipment using less carbon-intensive energy is favored. For example, the heating and air conditioning equipment in La Galerie le Phare de l’Europe shopping center in Brest using gas have been replaced by others using electricity, with a much lower carbon impact in metropolitan France.

- At the end of 2023, 50% of the energy consumption of Mercialys’ centers came from renewable sources, and 51% of the electricity consumed by Mercialys’ centers in mainland France was from renewable sources;

- 3 .Replace leak-prone air conditioning systems with new units that run on refrigerants with a lower global warming potential (GWP, i.e. the level of contribution to the greenhouse effect). Mercialys checks its facilities regularly and monitors refrigerant leaks on a monthly basis. Its overall leak rate in 2023 was 0.8%, well below the national average, which is 9%Source: ADEME – ARMINES, 2011.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(6). At the same time, Mercialys is exploring less-polluting alternatives to conventional refrigerants. All of these factors are an integral part of Mercialys’ refrigerant replacement strategy.

- 4 .As a last resort, Mercialys may have to offset its incompressible residual emissions. It has not yet resorted to this option.

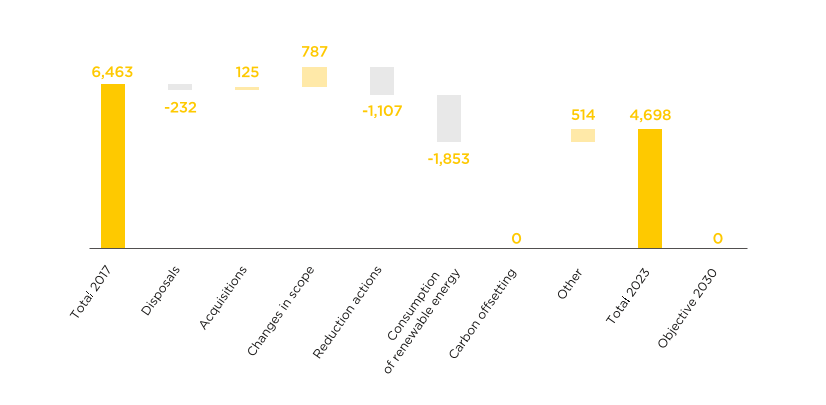

Mercialys has assessed the impact of these measures, as well as external factors, to analyze the factors used to reduce its carbon emissions (see graph below).

Change in scope 1 and 2 carbon emissions

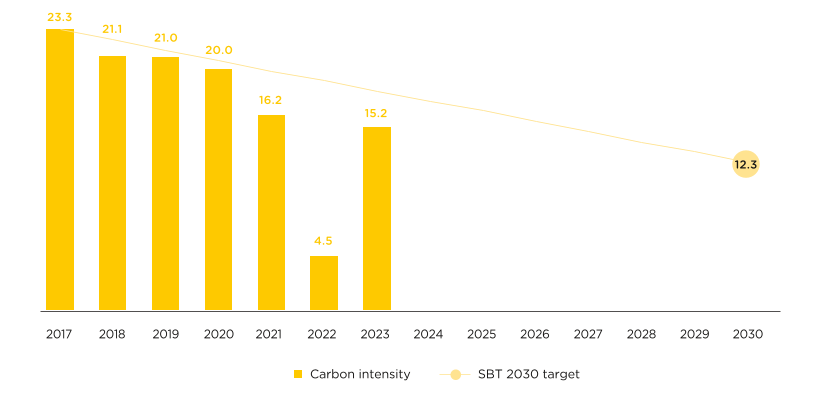

As such, the reduction in greenhouse gas emissions since 2017 is linked to action taken by Mercialys, whether in day-to-day management or investments. Thanks to these actions carried out over many years, Mercialys is ahead of its carbon roadmap for its scopes 1 and 2, as shown in the graph below.

Carbon intensity scopes 1 and 2 per sq.m.

Mercialys’ scope 1 and 2 greenhouse gas emissions increased between 2022 and 2023 due to the lower use of green energy contracts in 2023 compared to the previous year. The Company has initially refocused its efforts on reducing its energy consumption, while remaining in line with its carbon roadmap.

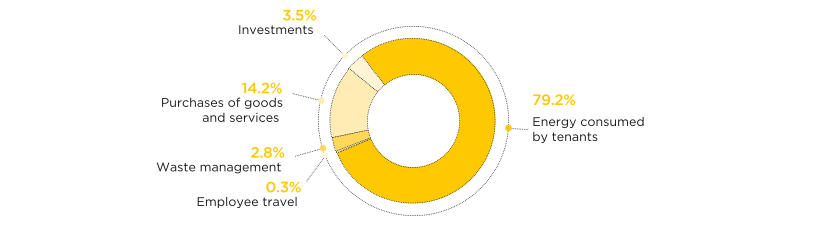

Enhance the approach by integrating scope 3

Meeting reduction commitments for scope 3 items involves the cooperation of all Mercialys’ stakeholders. Its main levers for involving the shopping centers’ tenants, employees and service providers are:

- ●working with retailers to reduce their energy consumption. For the past five years, retailers’ consumption has been logged for incorporation into the Company’s action plans and to provide them with comparative information useful for their operations (average energy consumption per square meter by type of activity, for instance, see p. 95);

- ●advising tenants on low-carbon electricity purchasing options;

- ●raising employees’ awareness of their business travel’s carbon impact. All employees are equipped with videoconferencing tools, widely used and the preferred option since 2020. The practice of teleworking, in place at Mercialys since 2017, is widespread (see p. 109 et seq.). In addition, the Company car leasing policy has been reviewed and now favors hybrid vehicles;

- ●working on the end-of-life treatment of the waste produced by the shopping centers. In conjunction with the waste collection services, Mercialys is seeking to optimize waste sorting and select the most energy-efficient outfalls in terms of carbon impact. These aspects were the subject of particular attention during the call for tenders conducted in 2023 (see p. 91).

Greenhouse gas emissions

SBT 2017-2030 objective

2023

2022

2021

2020

2019

2017

Change 2017-2023

Scopes 1 and 2

Energy for common areas and general services

(in kgCO2eq./sq.m.)

- 47

%

15.2

4.5

16.2

20.0

21.0

23.3

- 35

%

Scope 3

Energy consumed by tenants

(in kgCO2eq./sq.m.)

- 46

%

52.8

54.0

51.0

62.7

65.0

51.5

+ 3

%

Employee travel

(in tCO2eq.)

- 26

%

157.7

248.4

206.9

188.7

190.0

289.0

- 45

%

Waste management

(in tCO2eq./metric ton)

- 26

%

0.167

0.170

0.172

0.175

0.174

0.280

- 40

%

Mercialys is in line with its carbon roadmap and has already achieved two of its four objectives. In recognition of its active commitment to combating climate change, Mercialys has remained on the Carbon Disclosure Project (CDP) A List for the sixth consecutive year. This list is composed of the 346 companies worldwide considered leaders in the fight against climate change, out of over 23,000 participants listed in the CDP’s 2023 edition.

-

2.3For our stores

Because retail is undergoing major changes, notably driven by a need for proximity and meaning, Mercialys is committed to promoting more responsible retail by:

- ●offering its customers a range of more sustainable and ethical products and services in its certified centers;

- ●committing to its tenant retailers through a “responsible landlord tenant” pact.

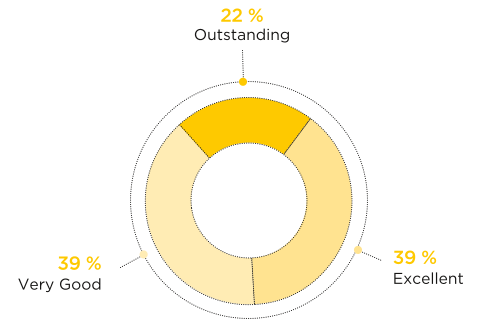

2.3.1100% of strategic assets BREEAM In-Use certified

Mercialys has been using the international environmental certification BREEAM In-Use as a simple, readable and scalable management tool for the assessment of its assets since 2014. This tool is used to support teams in the environmental management of sites. It provides a framework for comparing the assets of a portfolio, identifying best practices and highlighting the teams’ work on a daily basis. Furthermore, certification helps the Company to implement the work necessary to guarantee the resilience of its portfolio, in both environmental and societal terms, by taking into account emerging CSR issues. On the other hand, certified, energy-efficient and resilient shopping centers may represent differentiating added value likely to make the centers more attractive to visitors, tenants and investors. Lastly, certification also addresses the issues that need to be considered from the point of view of financial stakeholders, as evidenced by the Euro 385 million cumulative credit lines signed since 2021 that notably include this indicator (see p. 81).

In 2022, Mercialys began the migration of its certified portfolio to the new version of the BREEAM In-Use standard (version 6). This new version, which is more rigorous than the previous one, strengthens the environmental resilience aspect. All the strategic centers assessed according to this new version were deemed Very Good for the asset management component, and 6 reached the higher level of Excellent. These results attest to the daily commitment of the teams, since only one third of BREEAM In-Use v6 certified retail assets in France are certified Very Good or aboveAs of January 3, 2024, according to the list provided by the BRE Group on its website https://tools.breeam.com/projects/explore/buildings.jsp</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(10). Mercialys is thus proving its ability to maintain its assets in line with the highest environmental standards and occupant comfort, in anticipation of new CSR challenges.

Certification level: asset management

All strategic assets are thus certified, with an average score of 72% in asset management. These excellent results testify to Mercialys’ maturity and its teams’ commitment to continually improving operational performance.

To continue its efforts, Mercialys has rolled out this certification beyond its strategic portfolio and currently covers 95% of its portfolio, as well as assets held in partnership with investors, who thus benefit from this expertise.

Environmental certification on operational performance

-

2.4For our communities

Because Mercialys is deeply rooted in local communities, it is committed to being a major partner to sustainable development, by:

- ●forging special links that create mutual value with local players;

- ●developing mixed-use spaces that generate solid and diversified activities;

- ●supporting local employment through local recruitment and subcontracting and initiatives led by local teams.

2.4.1100% of centers committed to robust regional development

Shopping centers are places where people meet and foster community cohesion. They thus play an active role in the cities where they are located, creating new forms of centrality. Aware of this responsibility, Mercialys places its centers right at the heart of their local ecosystem. They contribute to the economic development of the regions in which they are located, by generating, among other things, local employment.

Supporting jobs in the centers

Mercialys centers host more than 16,000 long-term jobs that cannot be relocated, generated by site retailers. Indeed, 95% of shopping center jobs in France are permanent contracts, higher than the national average of 85%Source: French National Shopping Centers Council (CNCC), Shopping centers, creating jobs and social ties, March 2017.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(13). Mercialys also broadcasts these jobs by publishing job offers from retailers on each center’s website and social media. The Company increased the visibility of 82 job opportunities with its tenant retailers in 2023.

Furthermore, the centers’ day-to-day management requires the involvement of numerous service providers (security, cleaning, etc.). In 2023, over 260 jobs were associated with on-site services.

Promoting jobs around shopping centers

The Company is also proactive in its support of employment in its economic regions. Every year, employment initiatives, such as job fairs or job datings are organized at the centers in partnership with local or national brands and recruitment agencies. The shopping centers provide these businesses with spaces to advertise their job vacancies. They may be tenants of the shopping center looking to recruit, or companies outside the center, present in the local region. For example, the Emploi Interaction bus was welcomed in the parking lot of the Espace Anjou shopping center in Angers, to promote local recruitment.

As another example, La Galerie Espaces Fenouillet formally opened a Relais Information Emploi unit in 2023. This is a service offered by the Fenouillet town council, the Pôle emploi jobs center and the CBE ("Nord 31 bassin d'emploi" committee). The units hosts workshops as well as providing information for jobseekers, employees and students as well as for companies looking for employees. Individual support is offered, as are collective workshops and local job offers with follow-up and networking.

Over the last two years, 70% of strategic centers have supported an employment or integration initiative.

Boosting regions

In order to revitalize the regions and their stores, Mercialys also signed a national partnership in 2021 with the Initiative France network, the leading non-profit network for financing and supporting entrepreneurs in France. It reflects the shared desire of the two players to support, in close synergy with local authorities, the economic development of the regions by facilitating the creation of businesses. The partnership is then implemented at the local level with each regional branch of the Company’s centers. At the end of 2023, 54% of strategic centers had committed to local Initiative France associations, which is reflected in a number of ways.

First of all, Mercialys brings its expertise by encouraging its center directors to participate in commissions and panels to award financing to local entrepreneurs. As trade experts, they can support and advise them on their projects by analyzing the business plans presented to obtain financing, for example.

Then, the Company offers spaces to allow entrepreneurs to test their commercial offer in real conditions. One such example is the Cornouaille shop in La Galerie Quimper's allée de la Galerie. 22% of the Company’s strategic centers set up such spaces in 2023. In total, Mercialys shopping centers indirectly donated Euro 19,000 in support of local entrepreneurs.

Another example of the partnership with the Initiative France network is the campaign conducted since mid-2022 by La Galerie Hyper 19 in Malemort, called “J’ouvre mon commerce à Malemort” (I open my business in Malemort). La Galerie, the Initiative Corrèze association and the town hall of Malemort have joined forces to promote the establishment of new stores within the shopping center. As part of the regional policy of urban revitalization and economic development, this innovative approach consists of offering people wishing to set up a business all of the conditions needed to open new stores: premises with negotiated rents, 0% interest financial support, bridging loans, assistance in kickstarting their project, technical assistance, and support with administrative procedures. As part of this partnership with the Initiative France association, Mercialys received the “Ethical Innovation” Award from Sopra Steria Next and Public Sénat in 2022.

In addition, Mercialys has renewed its partnership with the Villes de France association and is thus perpetuating its contribution to the economy and employment of “mid-size” citiesCities with between 10,000 and 100,000 inhabitants and their suburbs nationwide.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(14).

Through all of these initiatives, Mercialys is involved in helping to revitalize neighborhood stores by providing its expertise, support and tools, in addition to financial sponsorship.

Regional development

-

2.5For our talents

Mercialys firmly believes that strong ethics, combined with strategic, inclusive and dynamic talent management, are sources of wealth and performance for itself and for its stakeholders.

The Company, as a responsible employer, has been committed for several years to a responsible approach based on four pillars:

- ●maintaining a very high level of ethics;

- ●promoting diversity and benefiting from inclusion;

- ●developing skills and enhancing individual potential;

- ●retaining talent and promoting employee engagement.

2.5.1An employer committed to maintaining a very high level of ethics

Clearly defined business ethics commitments and procedures

Mercialys' commitment to this approach is reflected in its employees' strong involvement in ethics and regulatory compliance. This approach is overseen by the Ethics and Compliance Director, who is also the Company’s Ethics Officer. She reports directly to the Deputy Chief Executive Officer.

In terms of ethics and compliance, the Company’s objective is to reduce its exposure to the risks associated with non-compliance with regulations and thereby contribute to strengthening its reputation and ability to attract and retain employees.

In terms of compliance, Mercialys has structured operational and financial control processes to ensure that all laws and regulations relating to its business are complied with. They apply to the various decision-making chains giving rise to the Company’s engagement with its various internal and external stakeholders. This approach contributes to the mitigation of the Company’s risks, as described in chapter 5 of this Universal Registration Document. In addition to the control procedures, the compliance approach at Mercialys is deeply linked to the concept of ethics, and is regularly explained and reminded to all employees.

The Mercialys Code of Ethics and Code of Conduct reiterates the need to respect the major international fundamental principles, legislation and the environment. This document also formalizes the commitments made and the resulting rules of behavior in all of the Company’s business lines and for all employees.

This charter reiterates that the Company operates exclusively in mainland France, Corsica and Reunion Island, and that all of its employees work in France, a country that has ratified the eight fundamental conventions of the International Labor Organization (ILO). These regulations therefore apply in particular to the fight against discrimination at work, freedom of association and the recognition of the right to collective bargaining, the elimination of all forms of forced or compulsory labor, and the abolition of child labor.

Mercialys strives to scrupulously comply with these conventions and all ethical regulations applicable to the business world.

Moreover, Mercialys has been a signatory to the UN Global Compact since 2018. This commitment demonstrates its will to respect the ten universal principles relating to human rights, international labor standards, environmental protection and the fight against corruption, and to ensure that its suppliers and subcontractors do likewise.

Mercialys has introduced a Code of Ethics and a Code of Conduct that its employees undertake to respect and uphold in the performance of their duties, for the smooth running of the business.

- ●respect for the environment and the measures implemented to reduce the Company’s environmental footprint;

- ●prevention of conflicts of interests;

- ●fight against money laundering and financing of terrorism;

- ●fight against corruption;

- ●the duty of care;

- ●oversight of lobbying practices via Responsible lobbying guidelines;

- ●inside information and prevention of insider trading;

- ●non-financing of political life;

- ●protection of employees’ health and safety;

- ●prevention of discriminatory actions and the right to union representation;

- ●the whistleblowing procedure.

This charter is given to all new employees joining the Company. It is also displayed on Mercialys’ intranet and websitesThe Code of Ethics and Code of Conduct are available on the Company’s website: https://www.mercialys.com/strategy-governance/commitments/code-of-ethics.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(18), in French and English.

It should be noted that, although Mercialys is not subject to certain provisions of the so-called “Sapin II” LawLaw No. 2016-1691 of December 9, 2016 on transparency, the fight against corruption and the modernization of the economy.</p>" style="letter-spacing:-0.02em;font-size:0.75em;vertical-align:super;line-height:0;">(19), the Company applies a determined approach to controlling this risk. Mercialys deals with the risk of corruption both in terms of compliance with the ethical rules that the Company wants all employees to respect, but also as an operational and financial hazard. As such, the Company conducts continuous checks and dialog with its various Departments.

The challenge is not only to deal with significant financial risks, but to identify behavior to be avoided. The scope of controls carried out to prevent corruption concerns the activities managed by Mercialys on its own behalf, the activities subcontracted by Mercialys, as well as the activities managed by Mercialys on behalf of its partners. The aspects of passive and active corruption are addressed by the control procedures put in place.

Specific approaches and procedures to ensure all aspects of the Company’s compliance policy are applied

As Mercialys is a listed company, compliance with stock market regulations is an important issue for all employees. In this respect, a regularly updated Stock Market Code of Ethics is published on the Company’s intranet site, outlining the regulations applicable to executives, directors, members of the Management Committee, persons closely related to them, insiders and more generally to any other person concerned.

A procedure for the protection of whistleblowers is also in place. Employees are regularly reminded of this procedure, which is also clearly displayed in Mercialys’ head offices, including the measures to improve this protection put in place by the Law of March 21, 2022. It guarantees confidentiality, as required by law, and allows whistleblowers to contact the Ethics Officer directly by telephone or email. The whistleblower is informed in writing of the receipt of their report within seven days. No reports were made via this system in either 2022 or 2023. Employees are also free to ask the Ethics Officer about any issues that they may wish to raise.

Furthermore, with a view to maintaining ethical, well-balanced business relations with retailers, Mercialys has signed the NEGO4GOOD Charter. This charter contains the four fundamental principles of ethical and responsible negotiation.

Responsible lobbying guidelines were also drawn up in 2020. The Director of Development and Institutional Relations is responsible for lobbying activities and ensures that the influencing strategy does not generate conflicts of interests. In 2023, Mercialys declared two interest representatives to the HATVPThe French authority for transparency in public life.</p>" style="font-size:0.75em;vertical-align:super;line-height:0;">(20) at national level. A register of external persons met and the reason for the meetings has been put in place and is regularly updated. The procedure in place takes into consideration the extension of the regulations to actions carried out at local level, applicable since July 1, 2022.

To ensure that Mercialys’ ethics policy is properly disseminated, training on the following topics is provided annually to all employees:

- ●representation of interests, prevention of corruption, money laundering and conflicts of interest;

- ●employee protection mechanisms, particularly in terms of combating discrimination and setting up a whistleblower system;

- ●stock market ethics;

- ●the protection of personal data.

ETHICS TRAINING for employees

2023

2022

2021

2020

2019

Percentage of employees trained in ethics

96.4

%

94.6

%

97.1

%

96.9

%

82.9

%

Since 2022, employees sign an annual declaration on the existence or absence of conflicts of interest, in addition to the declaration signed when they join the Company.

Continuation of solidarity actions and partnerships

The Company’s approach to ethics is not only based on its policies and processes, but also encompasses a number of solidarity actions.

Solidarity and the associated partnerships are an integral part of Mercialys’ culture. In 2023, Mercialys renewed its non-profit partnership to promote the professional integration of young people and equal opportunities, with the Article 1 association. This association offers young students personalized educational support from a professional mentor, in order to help them through their integration and professional success, and in particular to find their first job.

Mercialys also supports the commitment of its employees to charity work, confident that this type of initiative is likely to promote employee involvement in civil society. This commitment is reflected in the participation in charitable community and sporting events, which the Company supports, such as the "Course de la Jonquille contre le Cancer" charity run held in March 2023. 53 employees took part in the event, divided into 11 teams, to raise money for the Institut Curie. Another such example is the "Foulées de l'Immobilier" race which took place over 12 days in June 2023.

-

Appendices

1.European Taxonomy Regulation

The European Taxonomy Regulation (EU) 2020/852 of June 18, 2020 on “the establishment of a framework to facilitate sustainable investment,” known as the EU Taxonomy, aims to define a common framework for the classification of environmentally sustainable activities. Its purpose is to drive investments towards activities contributing to the environmental transition to achieve the objectives defined in the European Green Deal.